Payment API

Overview of how to send outbound payments

Sending Payments

Our PayOut product allows your business to send payments using the New Payments Platform (NPP) via our easy-to-use Payments APIs. This guide will walk you through the steps you need to follow to make outbound real time payments using our Payments APIs.

API Reference

| API | Description | Method |

|---|---|---|

| Make a Payment | Make an outbound payment to the provided PayID or BSB/Account Number. Once made, you can poll for PaymentStatus using getPayment to determine whether or not the payment was settled to the payee. | POST |

| Get a Payment | Retrieves an existing payment by its ID. This uses the paymentId returned by the makePayment call. | GET |

| Search for Payments | Search for Payments by the clientPaymentId or payment date range. | POST |

Using the Payments API

Let's assume you already have an API Key (myapikey) and a clientId (MYBUSINESSID) with Azupay.

Who can I pay via PayOut?You can make a payment to a PayID or to a BSB and Account Number. The account must be an Australian bank account.

What banks are supported?We support payments to all BSB's (all Australian banks). However, to get instant payment, the BSB must be reachable via the New Payments Platform (NPP). >99% of Australian banks are connected to NPP.

We provide APIs to facilitate this check. You can also check whether an institution is reachable by checking the New Payments Platform Association (NPPA) website.

Adding funds to your PayOut account

PayOut sends funds out from a settlement account we hold on your behalf.

The PayOut account can be credited with funds as follows:

- Login to the dashboard

- Copy or note your TopUp PayID visible on your dashboard home page, if you do not see the TopUp PayID it may need to be enabled:

- Navigate to Settings

- Find the "TopUp PayID" section and click Enable

- Make a payment to the specified top-up PayID from your online banking.

Toping up your test bankTo top-up your account in test environment use our test-bank utility.

Making a payment

Supported PayID types

You can make a payment to a PayID which is either an:

- Phone Number (landline or mobile)

- ABN/ACN

- Organisation ID

Validating a PayID

Need a test PayID?You can use Test PayID's when playing with this API.

You can validate a PayID using the Check PayID Status API prior to making the actual payment. Simply make the following API call:

POST https://api.azupay.com.au/v1/payIDEnquiry

Authorization: SECR_MYBUSINESSID_myapikey

Content-Type: application/json{

"payID": "[email protected]",

"payIDType": "EMAIL"

}This should yield the following response:

{

"AccountStatus": {

"nppReachable": true,

"accountServices": [

"x2p1"

]

}

}-

AccountStatus.nppReachable: This indicates that the PayID is valid and since PayIDs are only on NPP you now know the account is reachable via the NPP. -

AccountStatus.accountServices: Provides a list of supported NPP servicesx2p1indicates that the account is hosted at an Osko certified institution

which provides stronger assurances of 'instantaneousness'.sctprovides a lower level 'instantaneousness' assurance.

Now that you have established that the PayID is reachable via NPP, you can progress to actually making

the payment!

Making a payment to a PayID

It's as simple as issuing an API call:

POST https://api.azupay.com.au/v1/payment

Authorization: SECR_MYBUSINESSID_myapikey

Content-Type: application/json{

"Payment": {

"clientPaymentId": "c8ec39dc-2a70-4440-bc92-0e8f1b263d8f",

"payeeName": "Mr Someone Somewhere",

"payID": "[email protected]",

"payIDType": "EMAIL",

"paymentAmount": "2200.00",

"paymentDescription": "Payment for wages August 2020.",

"paymentNotification": {

"paymentNotificationEndpointUrl": "string",

"paymentNotificationAuthorizationHeaderValue": "string"

}

}

}Ok, let's get the obvious stuff out of the way first:

Payment.payeeName: This is the account holder's namePayment.payID: This is the PayID you are making a payment toPayment.payIDType: This is the type of PayID. We are paying to an email address so this is set toEMAILPayment.paymentDescription: This is the description that will appear on the account holders bank statement

Next, the not so obvious stuff:

{

"Payment": {

"clientPaymentId": "c8ec39dc-2a70-4440-bc92-0e8f1b263d8f",

"payeeName": "Mr Someone Somewhere",

"payID": "[email protected]",

"payIDType": "EMAIL",

"paymentAmount": "2200.00",

"paymentDescription": "Payment for wages August 2020.",

"ultimatePayerName": "ABC Pty. Ltd."

}

}-

Payment.clientPaymentId: Use this field to specify an identifier that can be used to correlate this transaction

back to a record in your system. In this payroll example, you may consider using an id which is a composite of employeeid-month-year or a uuid as per the sample. -

Payment.ultimatePayerName: The name of the ultimate payer. Lets you control the Payer description (visible to the payee) on the payment:- If not populated, then your business name will appear i.e. "My business name".

- If populated, then the ultimate payer name will appear instead

Will the ulimate payer name be displayed by all banks?We will send this information to the payee's banks; however, it is important to note that different banks may have their own data mapping rules and interpretations of how they present information to their customers. Therefore, the Payer Name displayed may differ from one bank to another.

Once you submit the request, you will get the following response:

{

"PaymentStatus": {

"status": "CREATED",

"paymentId": "4412792d84524100b7e042add1c7be47",

"createdDatetime": "2021-07-10T06:39:39.749Z",

"currentBalance": 999

}

}PaymentStatus.status: A value ofCREATEDhere means that Azupay has accepted your request for making this payment by checking your account balance and ensuring that the PayID specified is valid.PaymentStatus.paymentId: This is a unique identifier generated by Azupay that can be used to enquire about the status of the payment in the future.PaymentStatus.createdDatetime: The time in GMT offset of when the payment was created.PaymentStatus.currentBalance: The current balance of your outbound payments account.

Now you can check the Payment status

Validating BSB

When using a BSB and Account Number, only the BSB can be validated for NPP reachability. It's not possible to validate that an Account Number is valid. This is still useful and can be done as follows:

POST https://api.azupay.com.au/v1/accountEnquiry

Authorization: SECR_MYBUSINESSID_myapikey

Content-Type: application/json{

"bsb": "123456"

}The response for this will be:

{

"AccountStatus": {

"nppReachable": true,

"accountServices": [

"x2p1"

]

}

}-

AccountStatus.nppReachable: This indicates that the BSB is NPP reachable. If this value is false then the payment will either route to Australia's older deferred settlement system (Direct Entry, DE) or will return an error code depending on configuration you set.- Our default is to automatically route to DE but you can choose to turn this off if real time settlement is critical to you. DE will typically settle next business day but may take up to 3 days.

-

AccountStatus.accountServices: Provides a list of supported NPP servicesx2p1indicates that the institution is Osko certified which provides stronger assurances of

'instantaneousness'.sctprovides a lower level 'instantaneousness' assurance.

Making a payment to a BSB and Account Number

Making a payment to a BSB and Account Number is the almost the same as Making a payment to a PayID.

As you might imagine the only difference in the POST /v1/payment call; omit the payID and payIDType fields and use bsb and accountNumber instead.

Validate if a BSB and Account number is associated with a PayID

There are some cases where you have the BSB, account number and payID and want to validate whether

the PayID is associated with the BSB and account number. For that you can add additional bsb and accountNumber to the parameters of the POST /v1/payIDEnquiry call.

POST https://api.azupay.com.au/v1/payIDEnquiry

Authorization: SECR_MYBUSINESSID_myapikey

Content-Type: application/json{

"payID": "[email protected]",

"payIDType": "EMAIL",

"bsb": "123456",

"accountNumber": "9876543"

}The response for this will be:

{

"AccountStatus": {

"nppReachable": true,

"accountServices": [

"x2p1"

],

"validBsb": true,

"validAccountNumber": true,

"bic11": "BANKXXXXXXX"

}

}validBsb: atruevalue here indicates that the BSB associated with PayID[email protected]matches the value supplied in the request fieldbsbvalidAccountNumber: atruevalue here indicates that the Account Number associated with PayID[email protected]matches the value supplied in the request fieldaccountNumberbic11: This field contains the BIC11 code of the underlying institution. This lets you identify the bank, i.e. Commonwealth Bank

Making a payment to an account that is not reachable via the NPP

Whilst the majority of Australian bank accounts are reachable by NPP, some remain accessible only via the slower and older Direct Entry (DE) network. Azupay supports payments to these older accounts via the same set of API's with a few key differences:

- Will typically settle next business day but can take up to 3 business days to settle.

- Can only be made to BSB and account number, not a PayID. A PayID is only accessible by the NPP.

- If the payment fails due to an issue on the target bank side then it will not be reported via the usual

PaymentStatus.statusfield of the AzupayGET /v1/paymentapi or the webhook. - You will receive a webhook for the transition to SETTLED status if successful or RETURNED if the receiving bank notifies of a problem only.

Checking for a Payment status

As the process of settling the payment into the target account is asynchronous, you will need to poll the payment

using the paymentId.

Polling is as simple as:

GET https://api.azupay.com.au/v1/payment?id=4412792d84524100b7e042add1c7be47

Authorization: SECR_MYBUSINESSID_myapikey

Content-Type: application/json{

"Payment": {

"clientPaymentId": "c8ec39dc-2a70-4440-bc92-0e8f1b263d8f",

"payeeName": "Mr Someone Somewhere",

"payID": "[email protected]",

"payIDType": "EMAIL",

"paymentAmount": "2200.00",

"paymentDescription": "Payment for wages August 2020."

},

"PaymentStatus": {

"paymentId": "4412792d84524100b7e042add1c7be47",

"currentBalance": 999,

"createdDatetime": "2021-07-10T06:39:39.749Z",

"settlementDatetime": "2021-07-10T06:39:39.398Z",

"completedDatetime": "2021-07-10T06:39:42.398Z",

"status": "SETTLED"

}

}Great! Looks like the payment has SETTLED and we have some additional timestamps - settlementDatetime and completedDatetime.

Payments can fail for a number of reasons. Some of these failures are immediate and others are identified after the

outbound payment request has been submitted. Immediate failures result in a failure response at the time of issuing

the POST /v1/payment call. Other failures are reflected in the PaymentStatus.status field of the outbound payment request. Here is a table outlining what each of these statuses mean:

| Status | Meaning |

|---|---|

CREATED | Azupay has accepted and is processing your request to make a payment |

SETTLED | The funds have been credited to the target account |

FAILED | The target institution has not accepted the funds. This could be because the account is no longer valid |

PENDING | Azupay is waiting for the institution to acknowledge the credit of funds |

RETURNED | The target institution initially SETTLED the payment but later returned it |

Avoiding Edge CasesThe best way to avoid edge cases is to make payments to a PayID and not a BSB and Account Number. This is because the latter does not allow for validation of account number value.

Failure reason codes

PaymentStatus.status field can be marked as FAILED for different reasons. The underlying reason will be captured in the PaymentStatus.failureReason field. These codes are standard across the NPP network amongst participants and are returned by the destination institution as opposed to azupay.

| Reason | Code Description |

|---|---|

| AB01 | Clearing process aborted due to timeout. NPP Error. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| AB02 | Clearing process aborted due to fatal error. NPP Error. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| AC02 | The Debtor Account Number is invalid or missing. |

| AC03 | The Payee is unable to accept a Clearing Request because the account to be credited does not exist. |

| AC05 | The original debtor account number is closed and a Payment Return (Unsolicited) cannot be made. |

| AC06 | The Account is blocked and cannot accept credits. This includes instances of suspected fraud, sanctions or a credit is unable to be applied to the account type e.g. mortgage, term deposit account. |

| AC07 | The account to be credited is closed. |

| AC14 | Account exists but cannot accept funds (unreachable via NPP) |

| AG01 | Account exists but does not support credits. |

| AG03 | The account to be credited is open, but cannot accept NPP credit for the NPP service. |

| AGNT | The account does not belong to the account servicer (i.e. incorrect agent/reference data usage) or the incorrect clearing and settlement agency relationships are used. |

| AM01 | The service prohibits the use of zero dollar Payments. |

| AM02 | The transaction is greater than the maximum NPP limit of $99,999,999,999 or rules of a service have a maximum amount limit. |

| AM03 | Where the currency cannot be applied to the specified account. The Interbank settlement Currency is not AUD. |

| AM06 | Specified transaction amount is less than agreed minimum. |

| AM12 | The Amount in the Clearing or Settlement Request is missing, invalid or the amount in the Settlement Request does not match to the amount in the Clearing Request. |

| AM13 | Transaction amount exceeds limits set by clearing system. |

| AM18 | Number of Transactions is Invalid. |

| AM19 | The Number of transactions does not equal to ‘1’. |

| AM22 | Unable to apply zero amount to designated account. |

| BE06 | End customer specified is not known at associated Sort/National Bank Code or does no longer exist in the books. |

| BE08 | Debtor name is missing. |

| BE18 | Contact details missing or invalid. |

| BE22 | The information regarding the Creditor Name is required but not provided. |

| CH17 | Element is not allowed. |

| CH20 | Number of decimal points not compatible with the currency. |

| CH21 | Mandatory element is missing. |

| DT01 | Invalid date (e.g. wrong or missing settlement date) |

| DT02 | The CreationDateTime in the GroupHeader is not as per the required format (UTC expressed without offset, i.e. YYYY-MM-DDThh:mm:ss.sssZ) or, where the date is too far in the past or in the future. |

| ED06 | (Full Participants Only) Under NPPA direction, Participants may reject clearing requests based on the FSS being unavailable. |

| FF01 | File Format incomplete or invalid. |

| FF04 | The Service Level code is not as per the specified format or is invalid based on the message type or membership. |

| FF08 | End to End ID missing or invalid. |

| FF10 | Unable to process due to back office issues or outage. |

| FF11 | Clearing Request rejected due it being subject to a previous abort operation. |

| RC05 | The BIC identifier is invalid or missing. |

| RR05 | Regulatory or Central Bank Reporting information missing, incomplete or invalid. |

| RR07 | Remittance information structure does not comply with rules for Payment type. |

| L001 | Cuscal account error. Cuscal is unable to debit funds to make the payment. Client should retry for up to 8 hours before failing the payment and crediting the customers account |

| PA01 | Participant Available. Receiving bank is experiences problems. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| PA02 | Participant Flooded. Receiving bank is experiences problems. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| PA03 | Participant Recovering. Receiving bank is experiences problems. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| PA04 | Participant Not Available. Receiving bank is experiences problems. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| PA05 | Participant Under Stress. Receiving bank is experiences problems. Client should retry for up to 8 hours before failing the payment and crediting the customers account. |

| TD03 | The file format is incomplete or invalid. |

Return reason codes

PaymentStatus.status field can be marked as RETURNED for different reasons. The underlying reason will be captured in the PaymentStatus.returnedReason field. These codes are standard across the NPP network amongst participants and are returned by the destination institution as opposed to azupay.

| Reason | Code Description |

|---|---|

| AC03 | Wrong IBAN in BSCT |

| AC04 | Account number specified has been closed on the bank of account’s books |

| AC06 | Account specified is blocked, prohibiting posting of transactions against it. |

| AM03 | Specified message amount is a non processable currency outside of existing agreement |

| AM05 | Duplication |

| AM09 | Amount received is not the amount agreed or expected |

| BE05 | Party who initiated the message is not recognised by the end customer |

| BE08 | Returned as a result of a bank error |

Outbound Payments Search Guide

Overview

The Outbound Payment search API (POST /payment/search) is used to retrieve records of payments you have sent to external bank accounts or PayIDs.

Date Search Behavior

The date range filters apply to the Creation Date of the payment instruction. This identifies when your system requested the payment be sent, regardless of when it settled.

- Mode: Strictly searches for payment instructions created within the window.

Request Parameters

| Parameter | Type | Description |

|---|---|---|

| fromDate | String (ISO 8601) | The start of the date range (UTC). |

| toDate | String (ISO 8601) | The end of the date range (UTC). |

Example Request

// POST /payment/search

{

"PaymentSearch": {

"fromDate": "2023-01-01T00:00:00.000Z",

"toDate": "2023-01-31T23:59:59.999Z"

}

}Webhooks

If you prefer to receive an HTTP call whenever a payment has reached SETTLED or FAILED status,

you can do so by passing additional parameters for the endpoint and secret header when creating the Payment.

{

"Payment": {

"clientPaymentId": "c8ec39dc-2a70-4440-bc92-0e8f1b263d8f",

"payeeName": "Mr Someone Somewhere",

"payID": "[email protected]",

"payIDType": "EMAIL",

"paymentAmount": "2200.00",

"paymentDescription": "Payment for wages August 2020.",

"paymentNotification": {

"paymentNotificationEndpointUrl": "string",

"paymentNotificationAuthorizationHeaderValue": "string"

}

}

}Payment.paymentNotificationcan be populated to enable a webhook. This means that Azupay will invoke your webhook when the payment has eitherSETTLEDorFAILED(more on statuses later).Payment.paymentNotification.paymentNotificationEndpointUrl: Supply an internet accessible endpoint that Azupay can invoke.Payment.paymentNotification.paymentNotificationAuthorizationHeaderValue: Supply a value that can be used by Azupay to pass any authorization and authentication checks on your system. We highly recommend using a unique value per outbound payment for maximum security.

Webhook calls are made on a 'best effort' basisThis webhook call is made by Azupay on a best effort basis. Azupay will implement retry mechanisms to ensure transient network failures do not affect the ability to call this endpoint. Azupay may call this endpoint more than once with the same payload so the merchant must ensure that the endpoint implements idempotent behaviour.

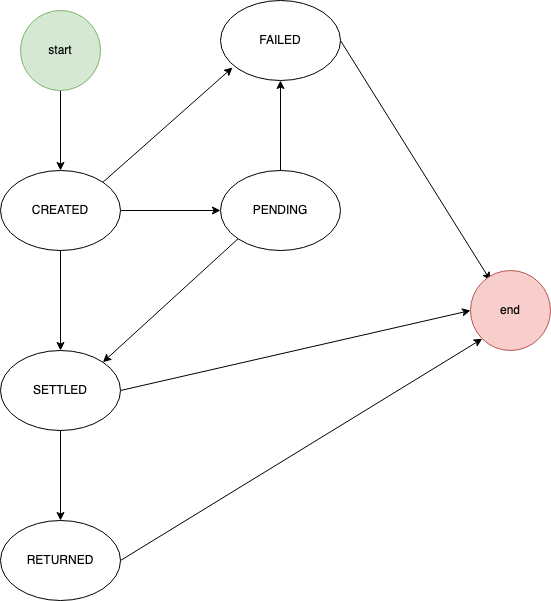

Payout statuses

The following is a state diagram for Payout payments.

| Status | Meaning |

|---|---|

CREATED | Azupay has accepted and is processing your request to make a payment |

SETTLED | The funds have been credited to the target account |

FAILED | The target institution has not accepted the funds. This could be because the account is no longer valid |

PENDING | Azupay is waiting for the institution to acknowledge the credit of funds |

RETURNED | The target institution initially SETTLED the payment but later returned it |

Payout limits

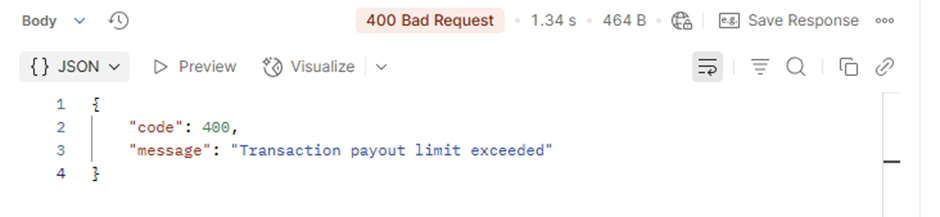

- Payout limits can be set for Azupay payout clients at a transaction level i.e if $1000 is a transaction limit then the you cannot make an individual outbound payment greater than $1000. If you attempt to make a payment higher than the set transaction limit then the payment will fail and you will receive an error code: 400 Bad Request, "Transaction payout limit exceeded"

- Daily transaction payout limits can be set for client accounts which looks at payments made over the current day from 12am of the day start to current time and ensuring the daily transaction limit is adhered to. If you attempt to make a payment that would make your account exceed the daily limit, then that payment will fail and you will receive an error code: 400 Bad Request: "Transaction payout limit exceeded"

- To set either a transaction limit or daily transaction limit, a service desk ticket must be raised for the limits to be set in your client account configuration

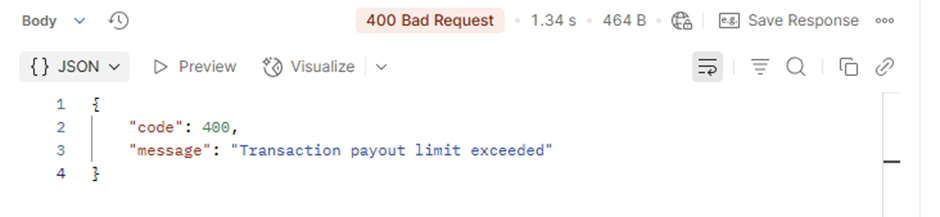

Payout limits for sub-merchants

Did you know the partners can specify payout limits for the sub-merchants that they manage? Partners can set payout limits at the transaction level or even at a daily transaction level

- Payout limits can be set for sub-merchants at a transaction level i.e if $1000 is a transaction limit then the sub-merchant client cannot make an individual outbound payment greater than $1000. If the client attempts to make a payment higher than the set transaction limit then the payment will fail and client will receive an error code: 400 Bad Request, "Transaction payout limit exceeded"

- Daily transaction payout limits can be set for sub-merchants which looks at payments made over the current day from 12am of the day start to current time and ensuring the daily transaction limit is adhered to. If a client attempts to make a payment that would make them exceed the daily limit, then that payment will fail and client will receive an error code: 400 Bad Request: "Transaction payout limit exceeded"

- Payout transaction limits (individual transaction limits and daily limits) are not inherited from the partner parent, and need to be set for each sub-merchant individually

- To set either a transaction limit or daily transaction limit, a service desk ticket must be raised for the limits to be set in the sub-merchant client configuration

Test Accounts

In the UAT environment, we provide you with fictitious accounts and PayID's in order to test all possible outbound payment outcomes for the AzupayOut product. These are listed below:

PayID's

| PayID | PayIDType | Expected Behaviour |

|---|---|---|

[email protected] | A call to POST /v1/payment will fail with 400 status code | |

[email protected] | Successful payment | |

orgnname | ORG | Successful payment |

+61-454444555 | PHONE | Successful payment |

34455445454 | ABN | Successful payment |

BSB and Account Numbers

| BSB | Account Number | POST /v1/payment | GET /v1/payment <br> PaymentStatus.status | GET /v1/payment <br> PaymentStatus.failureReason | GET /v1/payment <br> PaymentStatus.sentViaDE |

|---|---|---|---|---|---|

062000 | 12345999 | Will succeed | SETTLED | N/A | N/A |

062000 | 12345678 | Will succeed | FAILED | AGNT | N/A |

062000 | 12345777 | Will succeed | SETTLED | N/A | true |

062000 | 12345888 | Will succeed | PENDING then later SETTLED | N/A | N/A |

062000 | 12345444 | Will succeed | SETTLED then later RETURNED | N/A | N/A |

Updated 8 days ago