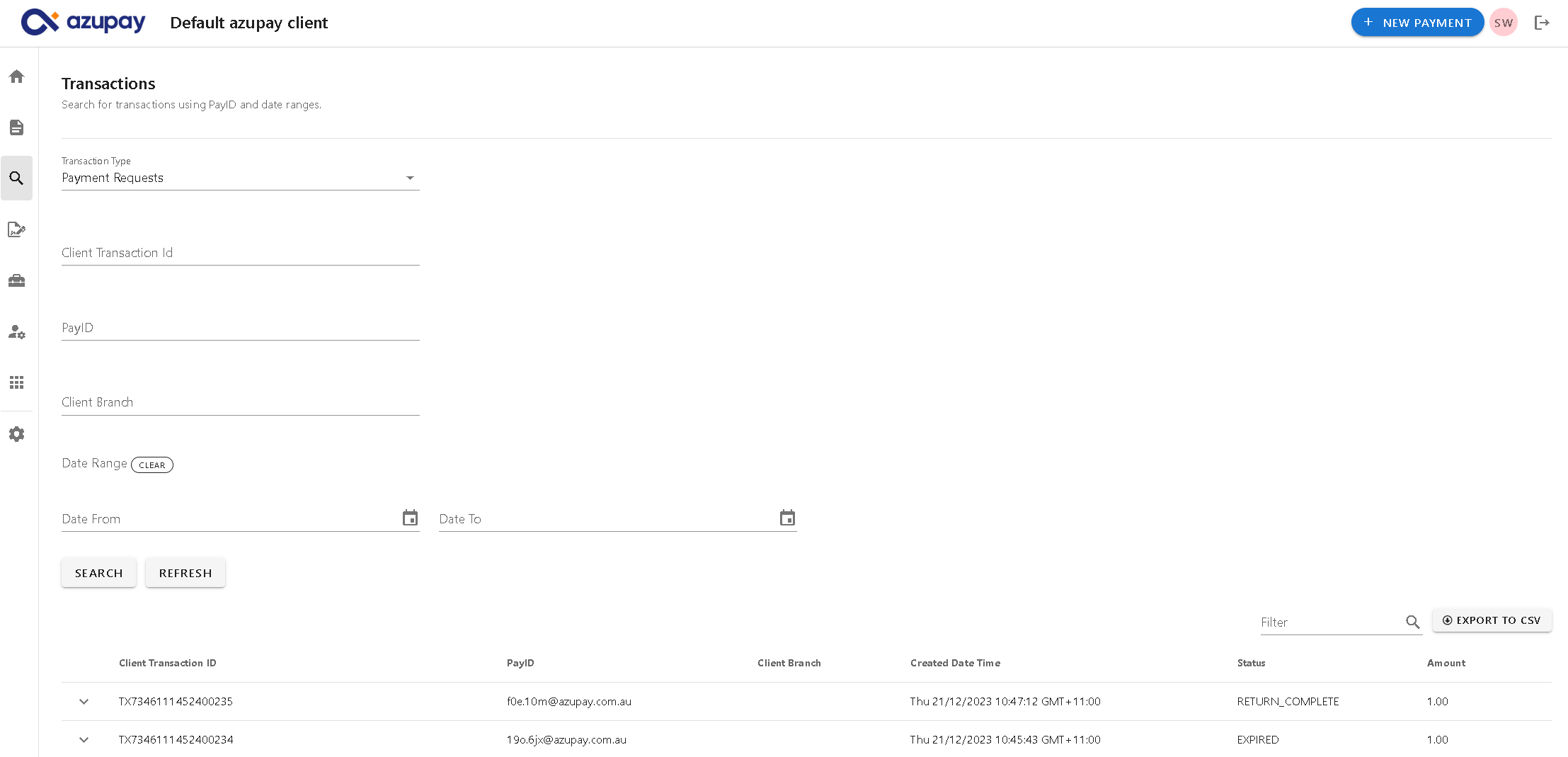

Search for transaction data

Transaction data includes payments received from Payment Requests and Payment Initiations as well as payments made out by PayOut. You can access this data as follows:

- Navigate to the Transactions view in the navigation bar

- You will be presented with a form where you can select from Payment Requests, Payment Initiations or Outbound Payment products

- You can specify additional search criteria such as PayID, Client Branch and / or dates to search by.

- Not all combinations of criteria are available for all transaction types, when a criteria is unavailable the field will be greyed out. If you need to search on a greyed out criteria try removing other search criteria

- Enter the appropriate search parameters and click Search

Payment Requests

Payment Requests search results show PaymentRequest's created in the POST /v1/paymentRequest call

Default search results - payment requests

Here is a description of the columns that you will see by default when landing on this page:

Field | Description |

|---|---|

Client Transaction ID | An ID you provide in the PaymentRequest to reference transaction data in your own systems |

PayID | This is the PayID to which your customer can make their payment to |

Client Branch | Additional transaction data point that you optionally choose to add to your PaymentRequests. Examples might include which branch or channel in your business generated the transaction |

Created Date | This is the date when the PayID for the payment request was created |

Status | The status of PaymentRequest. May be one of:

|

Amount | The requested payment amount |

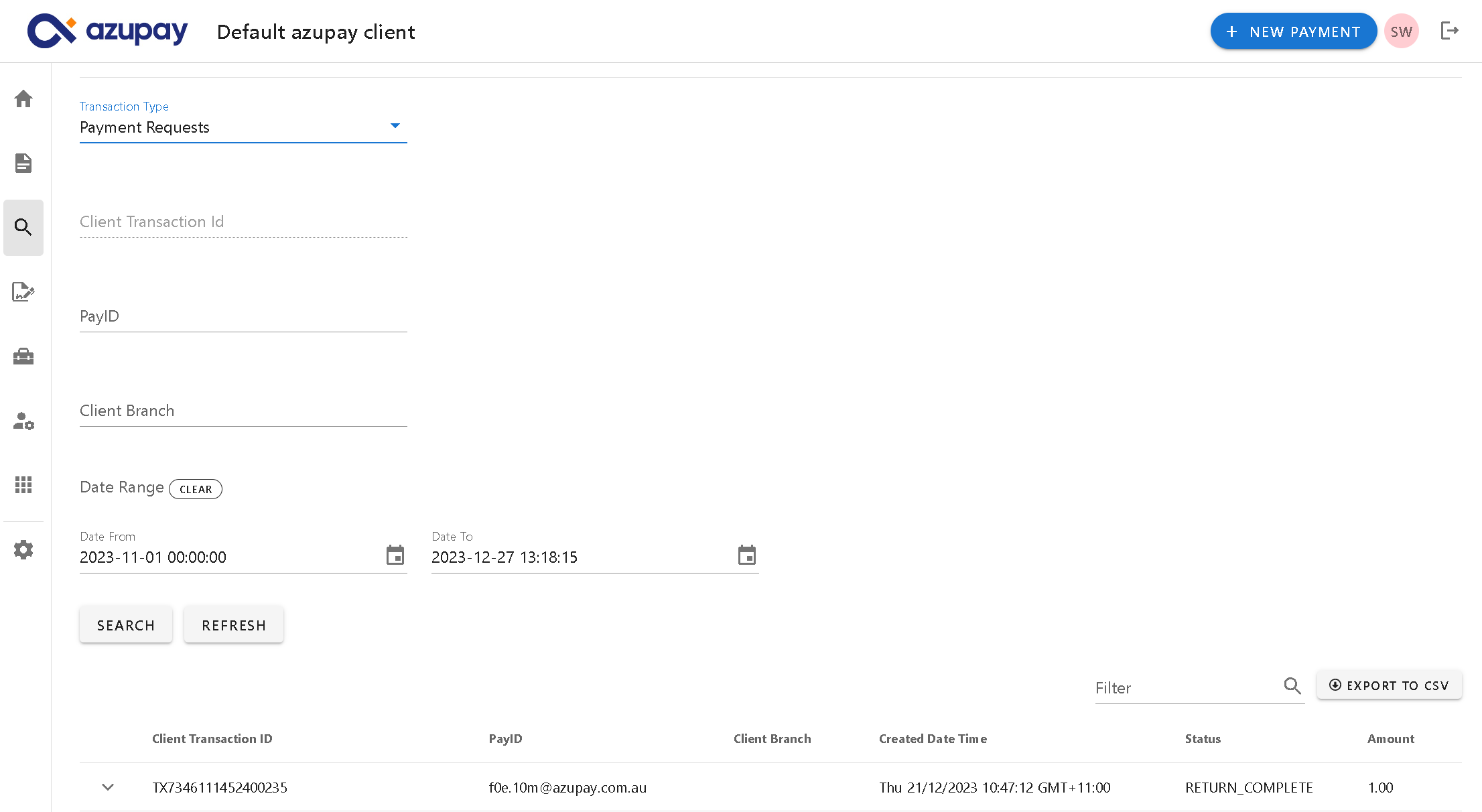

Search criteria

You are able to set search criteria to more easily find the specific transaction you are looking for. Search criteria fields you can set are:

- Client transaction ID: An ID you provide in the PaymentRequest to reference transaction data in your own systems

- PayID: This is the PayID to which your customer can make their payment to

- Client Branch: Additional transaction data point that you optionally choose to add to your PaymentRequests. Examples might include which branch or channel in your business generated the transaction

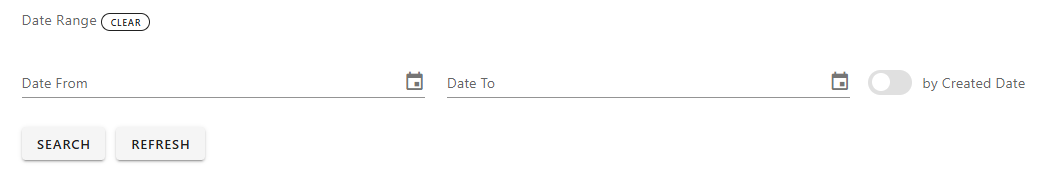

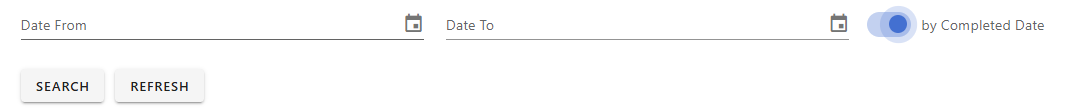

- Date From and Date To: date range, specifying the starting point ("from date") and ending point ("to date") of a time period you want to search within. This search criteria can return transaction search results based on transaction 'Completion date' (when a payment request was completed/paid or transaction 'Creation date' (when a payment request was created). (By default the search will provide results for all transactions in this date range using transaction 'Completion date'. You can select a toggle option to see search results for that date ranging using 'Creation date'.)

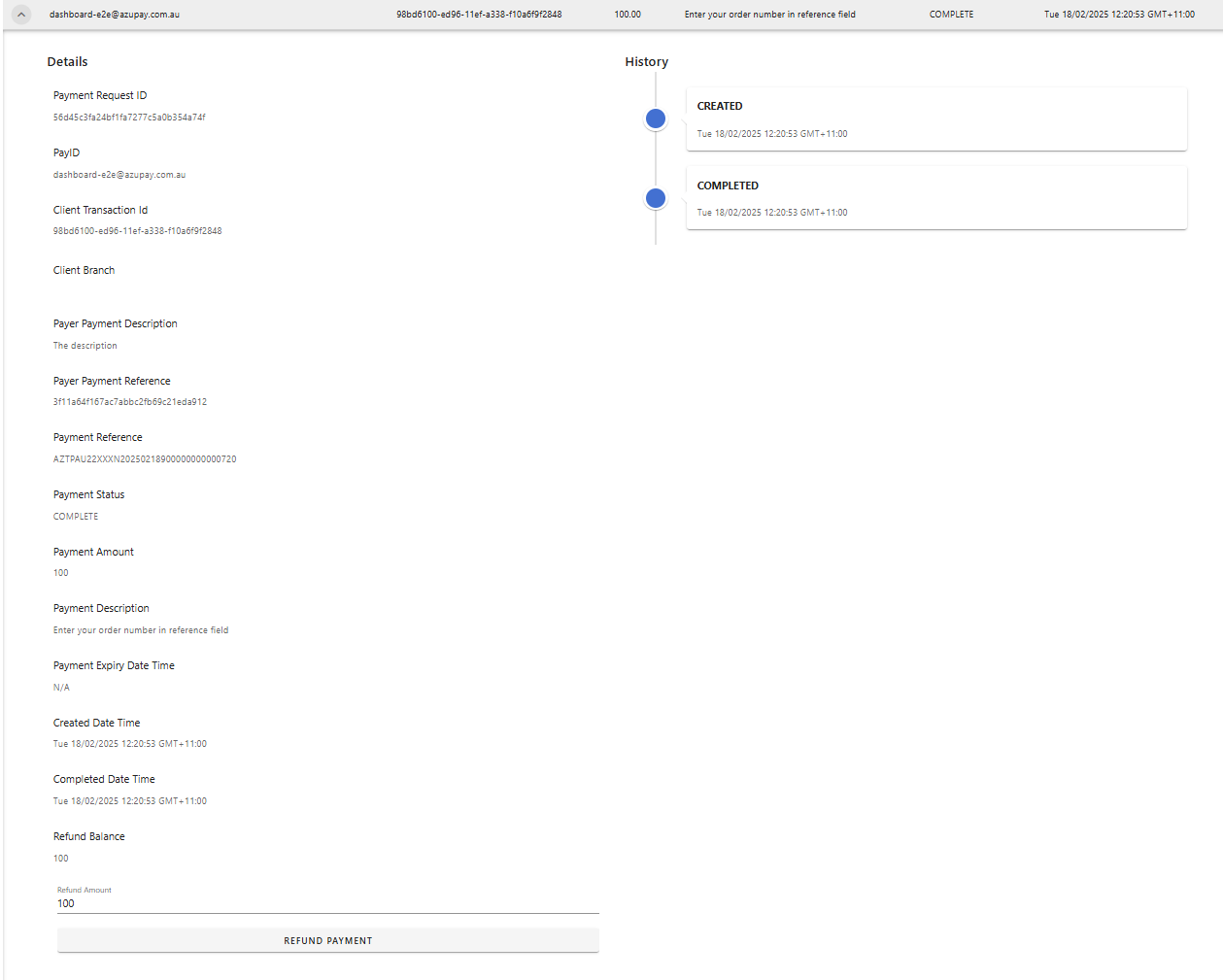

Payment request details

Each PaymentRequest can be expanded to show more details:

These details include:

- Other parameters supplied in the

POST /v1/paymentRequestcall such as payment description - Data received from the payer such as description, reference and where enabled source account information such as payee name, bsb and account number

- A timeline of events associated with this PaymentRequest

- The option to refund the payment back to the source account

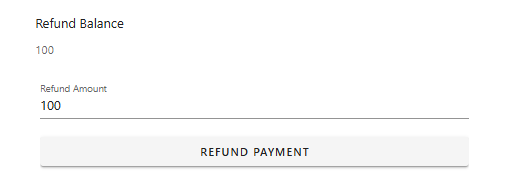

Refunding payment requests

Each Payment request transaction can be expanded to show more details including the option to refund the payment back to the source account and information on the amount available to be refunded.

Partial refund - Azupay dashboard

Steps to Complete:

- Navigate to Transactions, ensure Payment Requests is selected in the ‘Transaction type’ dropdown.

- Find transaction (search using Client Transaction ID, PayID, Client branch, Date range)

- Open accordian for transaction, enter amount to refund in the ‘Refund Amount’ field and click on button ‘Refund payment’

- Hit ‘Confirm’ to proceed with the partial refund

Full refund - Azupay dashboard

Steps to Complete

- Navigate to Transactions, ensure Payment Requests is selected in the ‘Transaction type’ dropdown

- Find transaction (search using Client Transaction ID, PayID, Client branch, Date range)

- Open accordian for transaction, click on button ‘Refund payment’,

- Hit ‘Confirm’ to proceed with the full refund

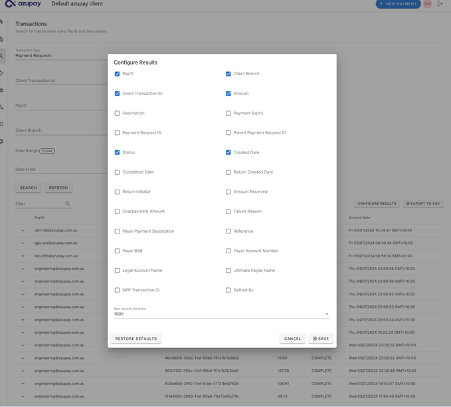

Configuring payment request search results.

Search results for payment requests include a button to 'Configure Results'. Use this to specify which columns you want to see displayed in the search results. Any columns selected will be included in the Export feature.

Additional columns to be selected for display in search results are as follows:

Field | Description |

|---|---|

Description | Description of this transaction. It will be the last part of the PayID name that appears in the customer's online banking when they lookup the PayID. |

Payment Expiry | Timestamp when the payment request expires and is no longer able to accept payments. |

Payment Request ID | An identifier generated by Azupay. Used to reference the object in subsequent operations such as getPaymentRequest and refundPaymentRequest |

Parent Payment Request ID | The paymentRequestId of a paymentRequest created with multiPayment set to true and for which this PaymentRequest was created and paid against. |

Completed Date | Timestamp when the payment was finalized in Azupay systems |

Return Created Date | Timestamp when refund request was initiated |

Return Initiator | AUTOMATIC for returns initiated when a payment to an expired PaymentRequest is received. MANUAL for returns initiated by the refund API or dashboard. |

Amount Received | The amount received from the customer |

Overpayment Amount | When the payment request is multiPayment and has a paymentAmount defined, the payer can overpay by mistake in which case the extra amount is refunded back to their account. This value represents the extra amount that was refunded back to the payer. If the payment was for the exact amount, the value of this field is zero. This field will only be present when the payment request is in COMPLETE state. |

Failure Reason | If status is failed or returned, this field will describe the reason for the failure. |

Payer Payment Description | The description supplied by the payer when making the payment |

Reference | The reference supplied by the payer when making the payment |

Payer BSB | BSB of the payer making payment |

Payer Account Number | Account number of the payer making payment |

Legal Account Name | Legal account name of the payer making payment |

Ultimate Payee Name | Used for specifying the name of the sub merchant for whom you are creating the PaymentRequest for. |

NPP Transaction ID | The identifier of the transaction in the NPP network. This is an identifier known by the initiating bank and serves as a unique identifier for the refund. |

Settled By | Specifies how this PaymentRequest was completed. Can be one of:

|

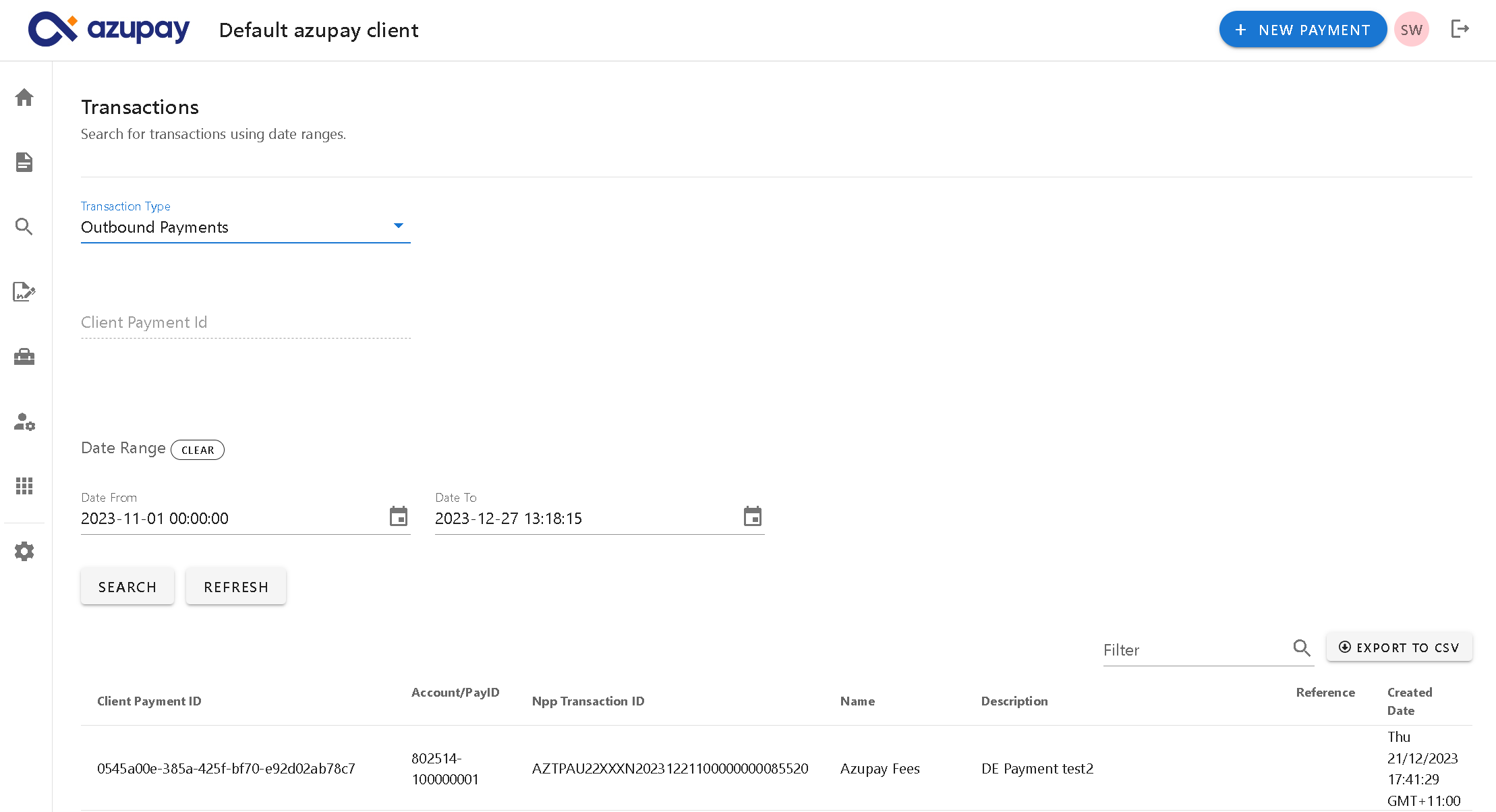

Outbound Payments

Outbound Payments search results show Payments made using the POST /v1/payment call

Default search results - outbound payments

Here is a description of the columns that you will see by default when landing on this page:

Column name | Column description |

|---|---|

Client Payment ID | An ID you provide in the Payment API call to reference transaction data in your own systems |

Account/PayID | The PayID or the BSB/Account Number to which the payment was made |

NPP Transaction ID | A transaction ID automatically applied by NPP as the payment is processed. It is possible the recipient of your funds will quote this reference number as they may see it on their bank statement. |

Name | The name of the Payee this payment is being sent to |

Description | Text you provide in the Payment API call |

Reference | A reference to the payee so that they can easily identify the payer or purpose of the transaction |

Created Date | Timestamp when the payment was made |

Status | The status of the payment. May be one of:

|

Amount | The requested payment amount |

Search criteria

You are able to set search criteria to more easily find the specific transaction you are looking for. Search criteria fields you can set are:

- Client Payment ID: An ID you provide in the Payment API call to reference transaction data in your own systems

- Date From and Date To: date range, specifying the starting point ("from date") and ending point ("to date") of a time period you want to search within. This search criteria will return transaction search results based on transaction 'Completion date'.

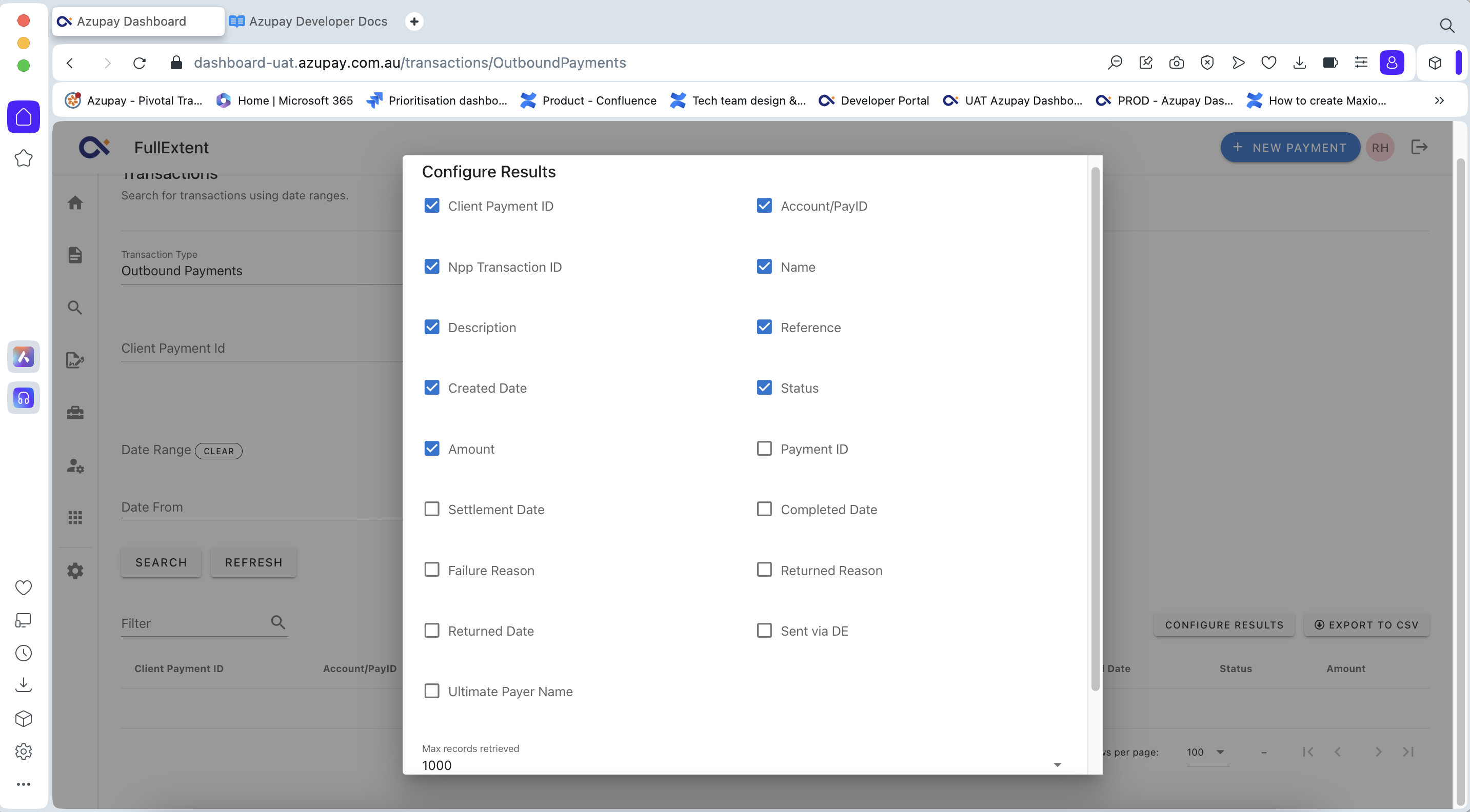

Configuring outbound payment search results.

Search results for outbound payments include a button to 'Configure Results'. Use this to specify which columns you want to see displayed in the search results. Any columns selected will be included in the Export feature.

Additional columns to be selected for display in search results are as follows:

| Column name | Column description |

|---|---|

| Settlement Date | Timestamp when the payment was settled. This will only show for payments that have status = 'settled' |

| Payment ID | An identifier generated by Azupay. Used to reference the object in subsequent operations such as getPayment |

| Completed Date | Timestamp when the payment was processed by Azupay. Only for status different than CREATED |

| Failure Reason | A reason code for a payment that is in status = FAILED |

| Returned Reason | A reason code for a payment that is in status = RETURNED |

| Returned Date | Timestamp when the payment was returned. Only if status = RETURNED |

| Sent via DE | This field is set to true when the payment was sent via the direct entry (DE) network. When true, this payment may take between 3 and 5 business days to settle |

| Ultimate Payer Name | The name of the ultimate payer. This name is visible to the payee on the payment |

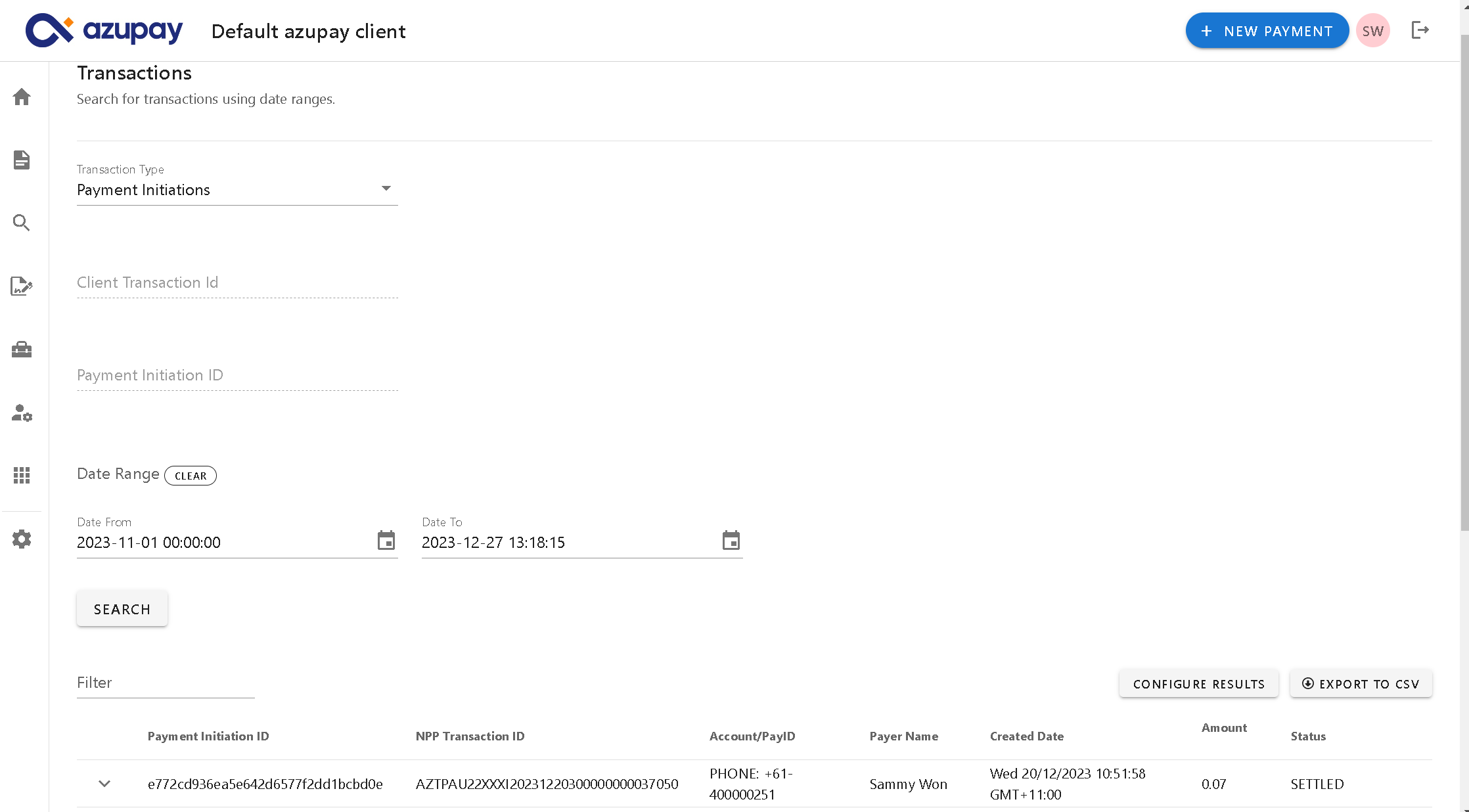

Payment Initiations

Payment Initiations search results show PaymentInitiation's created in the POST /v1/paymentInitiation call.

Default search results - payment initiations

Here is a description of the columns that you will see by default when landing on this page:

| Column Name | Column Description |

|---|---|

| Payment Initiation ID | ID that identifies the payment initiation |

| Account/PayID | Payer's Bank Account or PayID of the payment agreement |

| Payer Name | Payer's name of the payment agreement |

| Created Date | Date when the payment initiation was created |

| Status | Status of payment initiation. May be one of:

|

| Amount | Requested payment amount |

Search criteria

You are able to set search criteria to more easily find the specific transaction you are looking for. Search criteria fields you can set are:

- Client transaction ID: An ID you provide in the PaymentInitiation API call to reference transaction data in your own systems

- Payment initiation ID: An ID that identifies the payment initiation

- Date From and Date To: date range, specifying the starting point ("from date") and ending point ("to date") of a time period you want to search within. This search criteria will return transaction search results based on transaction 'Completion date' .

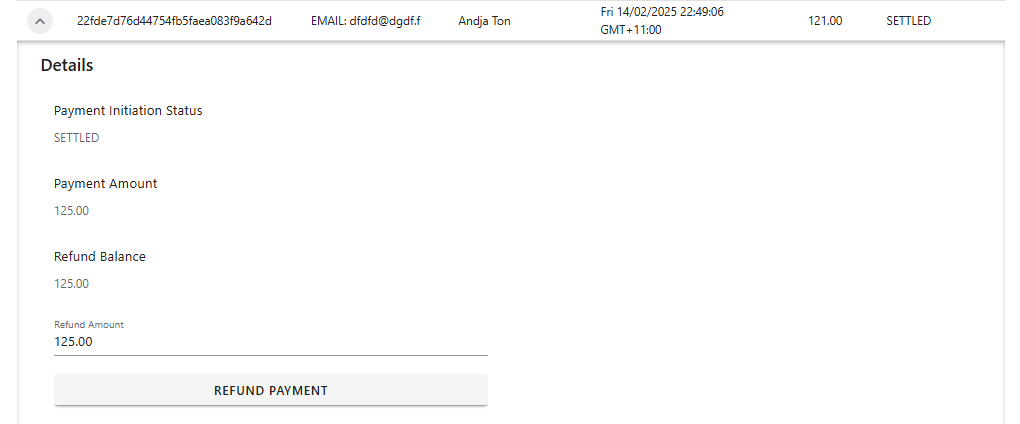

Refunding payment initiations

Each payment initiation transaction can be expanded to show more details including the option to refund the payment back to the source account and information on the amount available to be refunded.

Partial refund - Azupay dashboard

Steps to Complete:

- Navigate to Transactions, ensure Payment Initiations is selected in the ‘Transaction type’ dropdown.

- Find transaction (search using Client Transaction ID, PayID, Client branch, Date range)

- Open accordian for transaction, enter amount to refund in the ‘Refund Amount’ field and click on button ‘Refund payment’

- Hit ‘Confirm’ to proceed with the partial refund

Full refund - Azupay dashboard

Steps to Complete

- Navigate to Transactions, ensure Payment Requests is selected in the ‘Transaction type’ dropdown

- Find transaction (search using Client Transaction ID, PayID, Client branch, Date range)

- Open accordian for transaction, click on button ‘Refund payment’,

- Hit ‘Confirm’ to proceed with the full refund

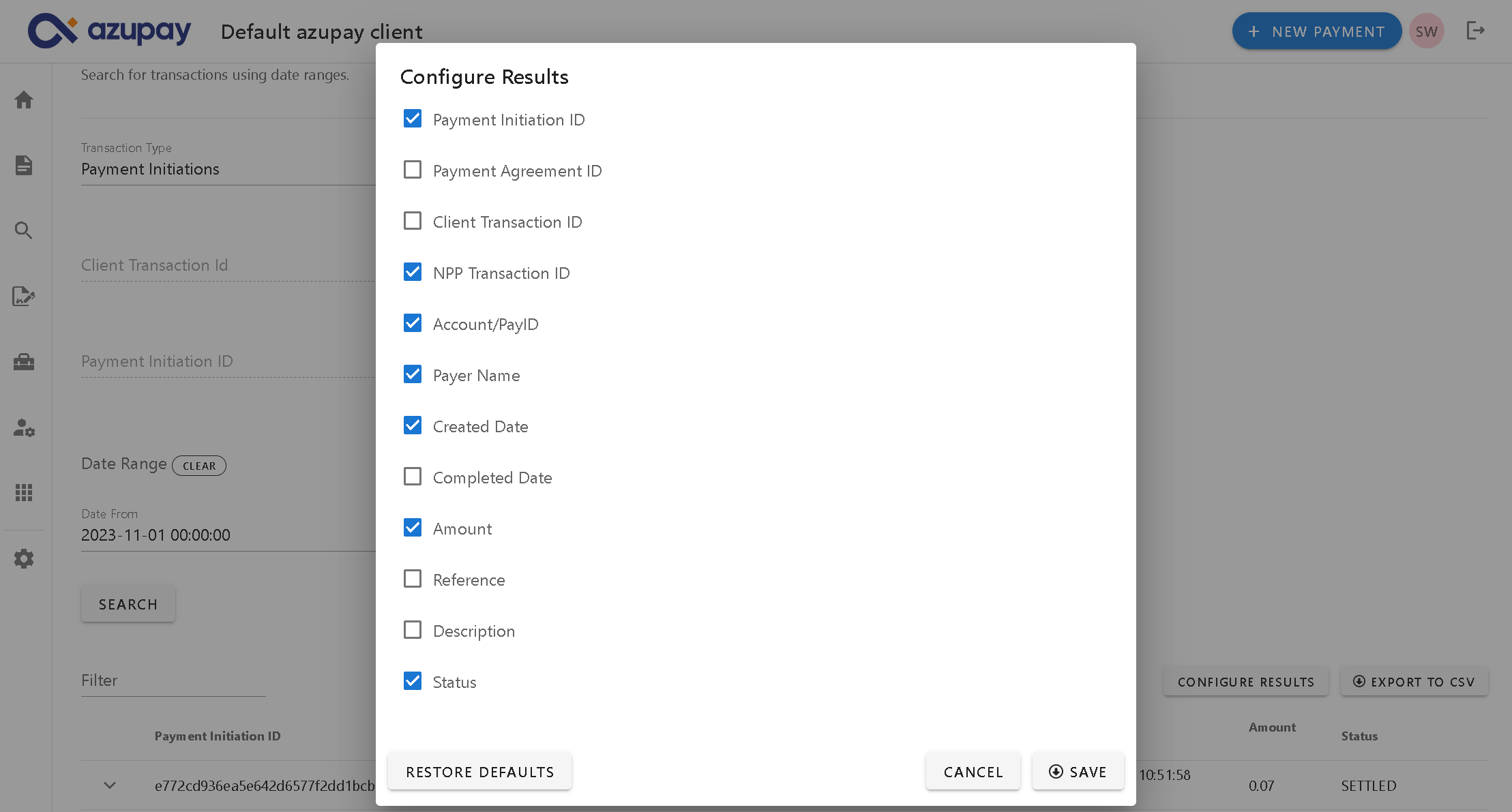

Configuring payment initiation payment search results

You can configure additional fields to be displayed by clicking the button and selecting the optional fields within the modal then saving. Any columns selected will be included in the Export feature.

Additional columns to be selected for display in search results are as follows:

| Column Name | Column Description |

|---|---|

| Payment Agreement ID | ID that identifies the payment agreement |

| Client Transaction ID | ID that identifies the transaction created by the merchant system |

| NPP Transaction ID | ID used to reference a payment pulled from a bank account between banks, businesses and payment facilitators such as Azupay |

| Completed Date | Date when the payment initiation was completed |

| Reference | This is used to unambiguously identify the payment initiation |

| Description | Optional remittance information used to unambiguously refer to the payment initiation |

Updated 10 months ago